Forecasting and forecast evaluation in mvgam

Nicholas J Clark

2026-02-13

Source:vignettes/forecast_evaluation.Rmd

forecast_evaluation.RmdThe purpose of this vignette is to show how the mvgam

package can be used to produce probabilistic forecasts and to evaluate

those forecasts using a variety of proper scoring rules.

Simulating discrete time series

We begin by simulating some data to show how forecasts are computed

and evaluated in mvgam. The sim_mvgam()

function can be used to simulate series that come from a variety of

response distributions as well as seasonal patterns and/or dynamic

temporal patterns. Here we simulate a collection of three time

count-valued series. These series all share the same seasonal pattern

but have different temporal dynamics. By setting

trend_model = GP() and prop_trend = 0.75, we

are generating time series that have smooth underlying temporal trends

(evolving as Gaussian Processes with squared exponential kernel) and

moderate seasonal patterns. The observations are Poisson-distributed and

we allow 10% of observations to be missing.

set.seed(1)

simdat <- sim_mvgam(

T = 100,

n_series = 3,

mu = 2,

trend_model = GP(),

prop_trend = 0.75,

family = poisson(),

prop_missing = 0.10

)The returned object is a list containing training and

testing data (sim_mvgam() automatically splits the data

into these folds for us) together with some other information about the

data generating process that was used to simulate the data

str(simdat)

#> List of 6

#> $ data_train :'data.frame': 225 obs. of 5 variables:

#> ..$ y : int [1:225] 6 NA 11 2 5 20 7 8 NA 11 ...

#> ..$ season: int [1:225] 1 1 1 2 2 2 3 3 3 4 ...

#> ..$ year : int [1:225] 1 1 1 1 1 1 1 1 1 1 ...

#> ..$ series: Factor w/ 3 levels "series_1","series_2",..: 1 2 3 1 2 3 1 2 3 1 ...

#> ..$ time : int [1:225] 1 1 1 2 2 2 3 3 3 4 ...

#> $ data_test :'data.frame': 75 obs. of 5 variables:

#> ..$ y : int [1:75] 4 23 8 3 NA 3 1 20 8 3 ...

#> ..$ season: int [1:75] 4 4 4 5 5 5 6 6 6 7 ...

#> ..$ year : int [1:75] 7 7 7 7 7 7 7 7 7 7 ...

#> ..$ series: Factor w/ 3 levels "series_1","series_2",..: 1 2 3 1 2 3 1 2 3 1 ...

#> ..$ time : int [1:75] 76 76 76 77 77 77 78 78 78 79 ...

#> $ true_corrs : num [1:3, 1:3] 1 0.0861 0.1161 0.0861 1 ...

#> $ true_trends : num [1:100, 1:3] -0.851 -0.758 -0.664 -0.571 -0.48 ...

#> $ global_seasonality: num [1:100] -0.966 -0.197 0.771 1.083 0.37 ...

#> $ trend_params :List of 2

#> ..$ alpha: num [1:3] 0.883 0.936 1.036

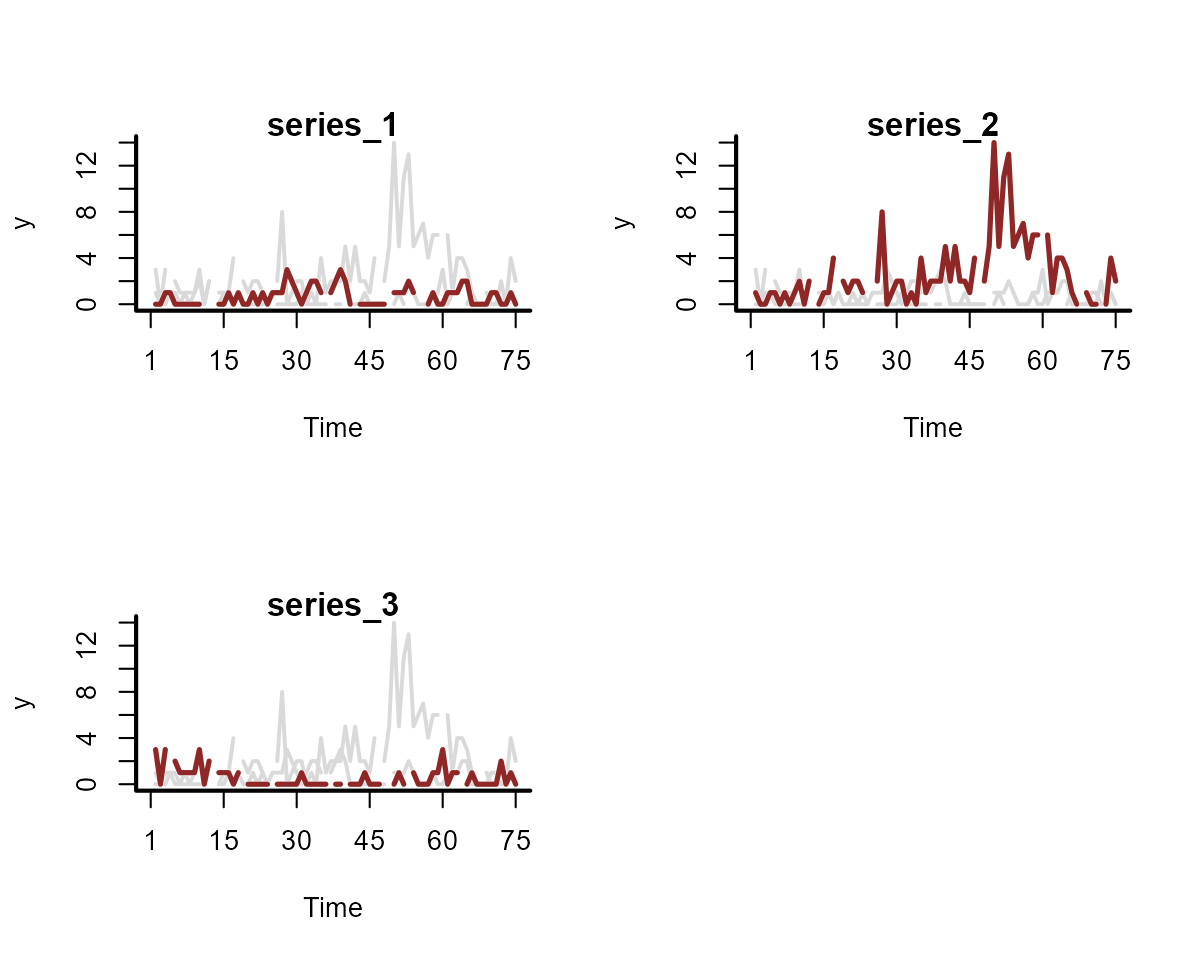

#> ..$ rho : num [1:3] 7.54 4.01 7.49Each series in this case has a shared seasonal pattern. The resulting time series are similar to what we might encounter when dealing with count-valued data that can take small counts:

plot_mvgam_series(

data = simdat$data_train,

series = "all"

)

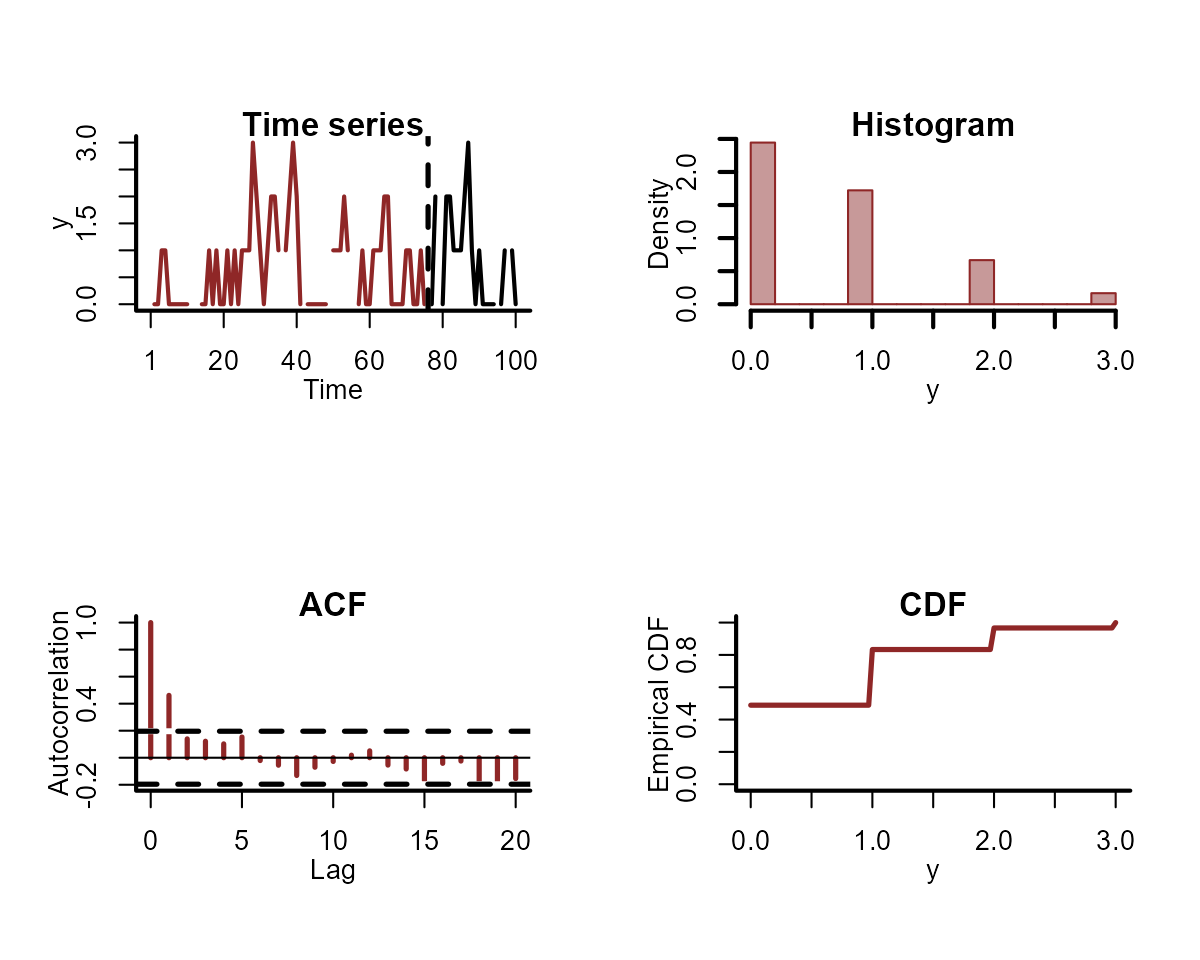

For individual series, we can plot the training and testing data, as well as some more specific features of the observed data:

plot_mvgam_series(

data = simdat$data_train,

newdata = simdat$data_test,

series = 1

)

Modelling dynamics with splines

The first model we will fit uses a shared cyclic spline to capture the repeated seasonality, as well as series-specific splines of time to capture the long-term dynamics. We allow the temporal splines to be fairly complex so they can capture as much of the temporal variation as possible:

mod1 <- mvgam(

y ~ s(season, bs = "cc", k = 8) +

s(time, by = series, bs = "cr", k = 20),

knots = list(season = c(0.5, 12.5)),

trend_model = "None",

data = simdat$data_train,

silent = 2

)The model fits without issue:

summary(mod1, include_betas = FALSE)

#> GAM formula:

#> y ~ s(season, bs = "cc", k = 8) + s(time, by = series, k = 20)

#>

#> Family:

#> poisson

#>

#> Link function:

#> log

#>

#> Trend model:

#> None

#>

#> N series:

#> 3

#>

#> N timepoints:

#> 100

#>

#> Status:

#> Fitted using Stan

#> 4 chains, each with iter = 1000; warmup = 500; thin = 1

#> Total post-warmup draws = 2000

#>

#> GAM coefficient (beta) estimates:

#> 2.5% 50% 97.5% Rhat n_eff

#> (Intercept) 1.9 1.9 2 1 1675

#>

#> Approximate significance of GAM smooths:

#> edf Ref.df Chi.sq p-value

#> s(season) 3.805 6 19.89 < 2e-16 ***

#> s(time):seriesseries_1 8.220 19 39.15 0.47726

#> s(time):seriesseries_2 8.745 19 45.62 0.00092 ***

#> s(time):seriesseries_3 6.487 19 55.63 < 2e-16 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Stan MCMC diagnostics:

#> ✔ No issues with effective samples per iteration

#> ✖ Rhats above 1.05 found for some parameters

#> Use pairs() and mcmc_plot() to investigate

#> ✔ No issues with divergences

#> ✖ 43 of 2000 iterations saturated the maximum tree depth of 10 (2.15%)

#> Try a larger max_treedepth to avoid saturation

#>

#> Samples were drawn using sampling(hmc). For each parameter, n_eff is a

#> crude measure of effective sample size, and Rhat is the potential scale

#> reduction factor on split MCMC chains (at convergence, Rhat = 1)

#>

#> Use how_to_cite() to get started describing this modelAnd we can plot the conditional effects of the splines (on the link scale) to see that they are estimated to be highly nonlinear

conditional_effects(mod1, type = "link")

Modelling dynamics with a correlated AR1

Before showing how to produce and evaluate forecasts, we will fit a

second model to these data so the two models can be compared. This model

is equivalent to the above, except we now use a correlated AR(1) process

to model series-specific dynamics. See ?AR for more

details.

mod2 <- mvgam(y ~ 1,

trend_formula = ~ s(season, bs = "cc", k = 8) - 1,

trend_knots = list(season = c(0.5, 12.5)),

trend_model = AR(cor = TRUE),

noncentred = TRUE,

data = simdat$data_train,

silent = 1

)The summary for this model now contains information on the autoregressive and process error parameters for each time series:

summary(mod2, include_betas = FALSE)

#> GAM observation formula:

#> y ~ 1

#>

#> GAM process formula:

#> ~s(season, bs = "cc", k = 8) - 1

#>

#> Family:

#> poisson

#>

#> Link function:

#> log

#>

#> Trend model:

#> AR(cor = TRUE)

#>

#> N process models:

#> 3

#>

#> N series:

#> 3

#>

#> N timepoints:

#> 75

#>

#> Status:

#> Fitted using Stan

#> 4 chains, each with iter = 1000; warmup = 500; thin = 1

#> Total post-warmup draws = 2000

#>

#> GAM observation model coefficient (beta) estimates:

#> 2.5% 50% 97.5% Rhat n_eff

#> (Intercept) 1.7 2 2.4 1 758

#>

#> standard deviation:

#> 2.5% 50% 97.5% Rhat n_eff

#> sigma[1] 0.24 0.33 0.45 1.01 526

#> sigma[2] 0.31 0.42 0.57 1.00 488

#> sigma[3] 0.18 0.25 0.36 1.01 280

#>

#> autoregressive coef 1:

#> 2.5% 50% 97.5% Rhat n_eff

#> ar1[1] 0.74 0.89 0.99 1.01 495

#> ar1[2] 0.66 0.82 0.96 1.01 476

#> ar1[3] 0.88 0.96 1.00 1.00 647

#>

#> Approximate significance of GAM process smooths:

#> edf Ref.df Chi.sq p-value

#> s(season) 2.935 6 17.58 4.09e-06 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Stan MCMC diagnostics:

#> ✔ No issues with effective samples per iteration

#> ✔ Rhat looks good for all parameters

#> ✔ No issues with divergences

#> ✔ No issues with maximum tree depth

#>

#> Samples were drawn using sampling(hmc). For each parameter, n_eff is a

#> crude measure of effective sample size, and Rhat is the potential scale

#> reduction factor on split MCMC chains (at convergence, Rhat = 1)

#>

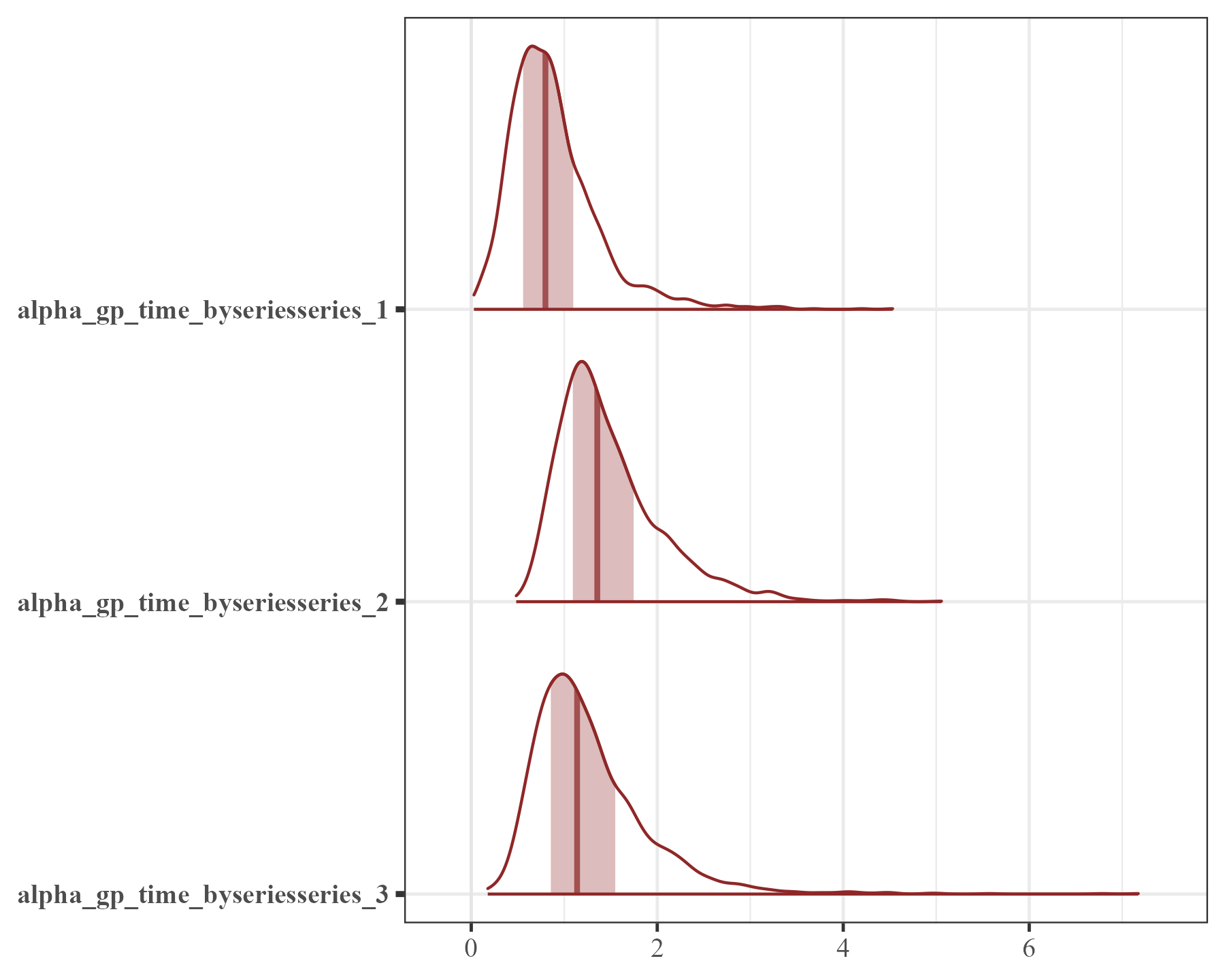

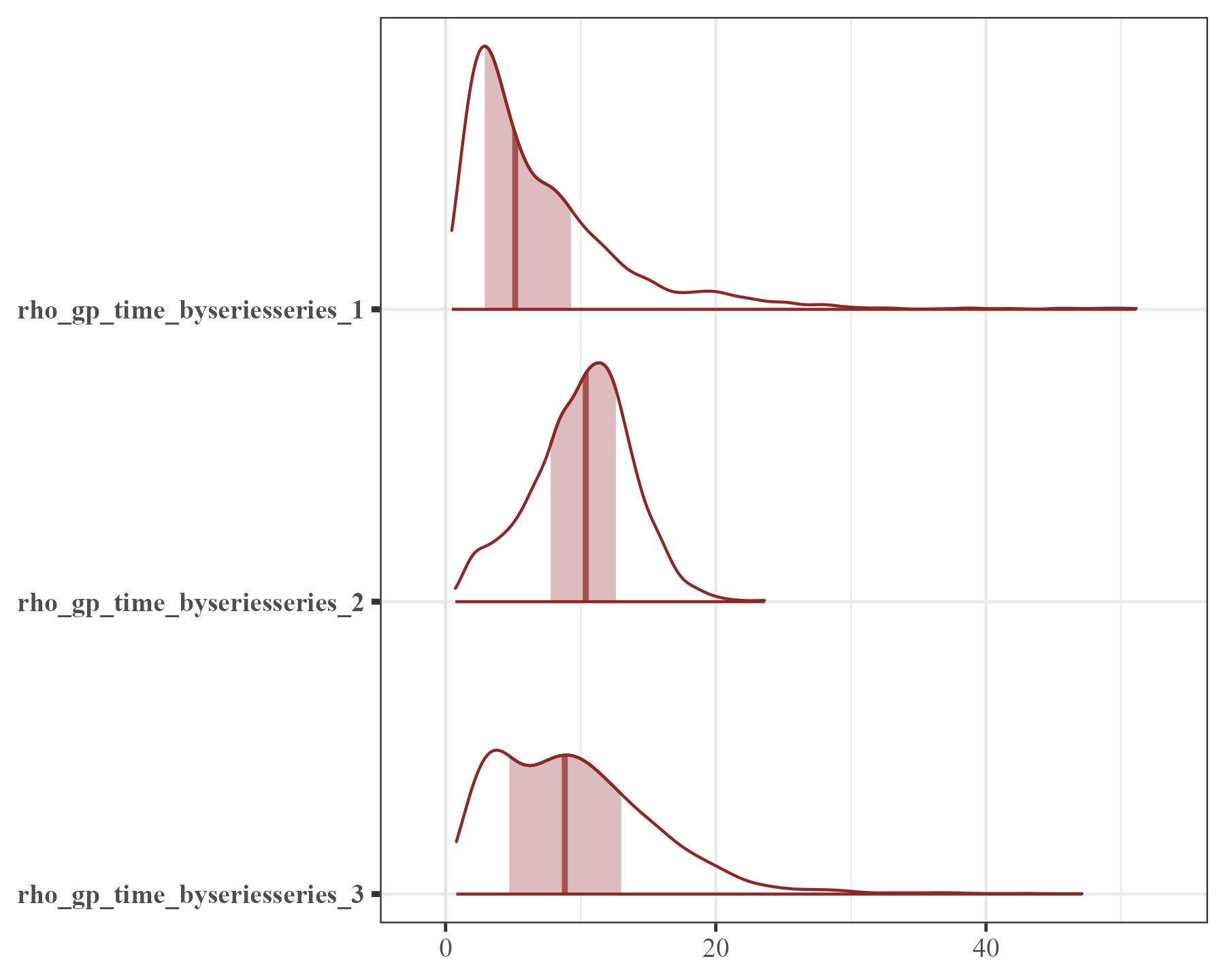

#> Use how_to_cite() to get started describing this modelWe can plot the posteriors for these parameters, and for any other

parameter for that matter, using bayesplot routines. First

the autoregressive parameters:

mcmc_plot(mod2, variable = "ar", regex = TRUE, type = "areas")

And now the variance (\(\sigma\)) parameters:

mcmc_plot(mod2, variable = "sigma", regex = TRUE, type = "areas")

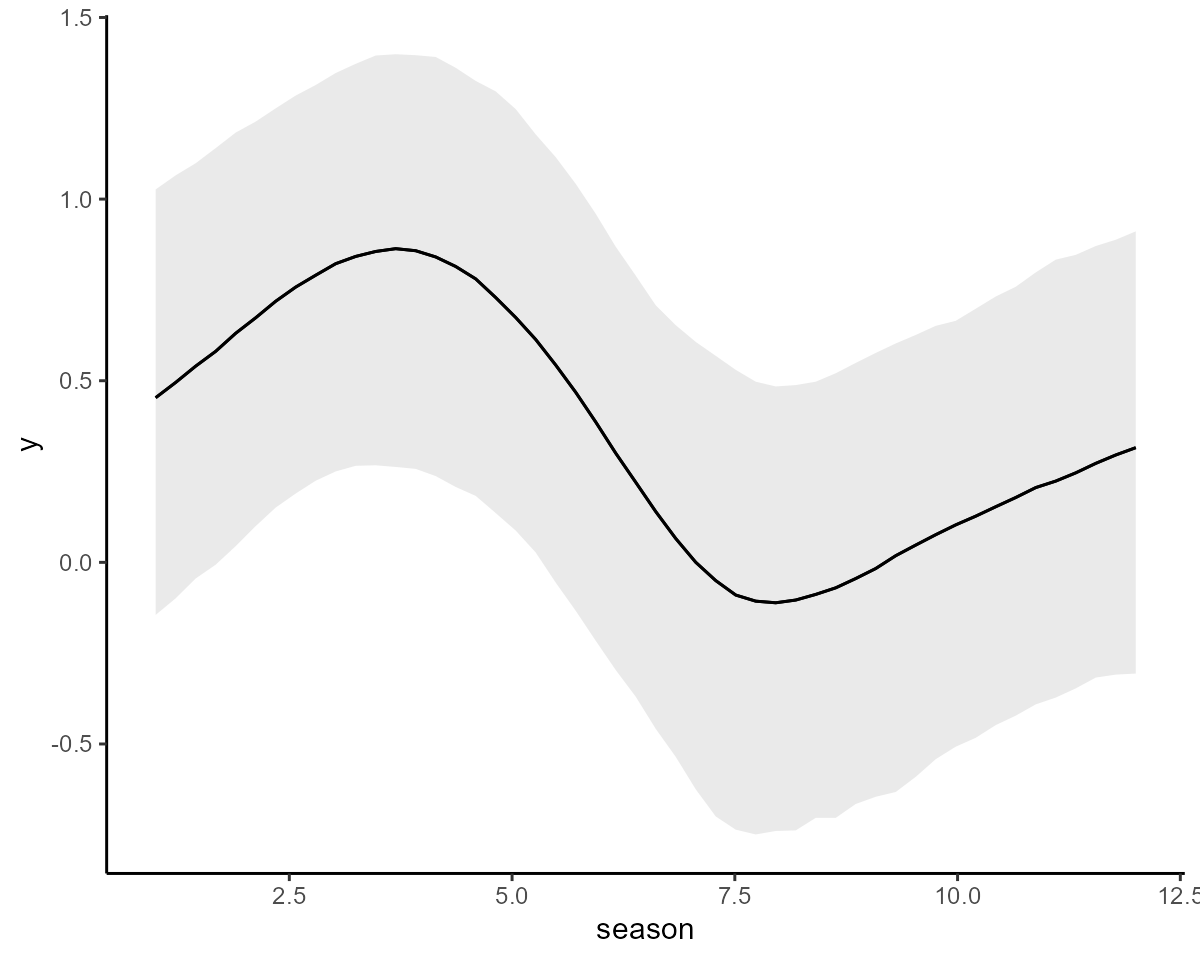

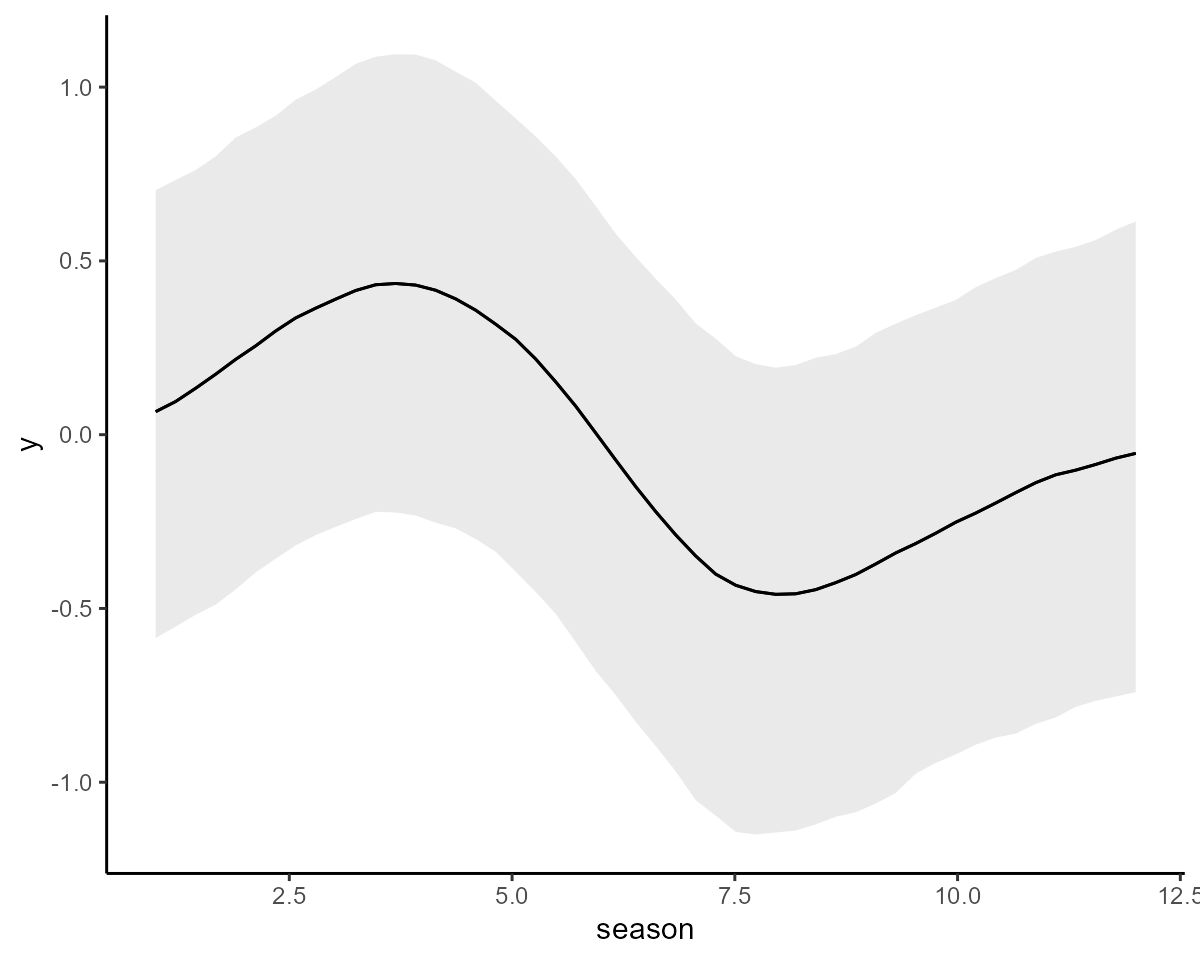

We can again plot the conditional seasonal effect:

conditional_effects(mod2, type = "link")

The estimates for the seasonal component are fairly similar for the two models, but below we will see if they produce similar forecasts

Forecasting with the forecast() function

Probabilistic forecasts can be computed in two main ways in

mvgam. The first is to take a model that was fit only to

training data (as we did above in the two example models) and produce

temporal predictions from the posterior predictive distribution by

feeding newdata to the forecast() function. It

is crucial that any newdata fed to the

forecast() function follows on sequentially from the data

that was used to fit the model (this is not internally checked by the

package because it might be a headache to do so when data are not

supplied in a specific time-order). When calling the

forecast() function, you have the option to generate

different kinds of predictions (i.e. predicting on the link scale,

response scale or to produce expectations; see

?forecast.mvgam for details). We will use the default and

produce forecasts on the response scale, which is the most common way to

evaluate forecast distributions

fc_mod1 <- forecast(mod1, newdata = simdat$data_test)

fc_mod2 <- forecast(mod2, newdata = simdat$data_test)The objects we have created are of class mvgam_forecast,

which contain information on hindcast distributions, forecast

distributions and true observations for each series in the data:

str(fc_mod1)

#> List of 16

#> $ call :Class 'formula' language y ~ s(season, bs = "cc", k = 8) + s(time, by = series, k = 20)

#> .. ..- attr(*, ".Environment")=<environment: R_GlobalEnv>

#> $ trend_call : NULL

#> $ family : chr "poisson"

#> $ family_pars : NULL

#> $ trend_model : chr "None"

#> $ drift : logi FALSE

#> $ use_lv : logi FALSE

#> $ fit_engine : chr "stan"

#> $ type : chr "response"

#> $ series_names : Factor w/ 3 levels "series_1","series_2",..: 1 2 3

#> $ train_observations:List of 3

#> ..$ series_1: int [1:75] 6 2 7 11 8 6 9 11 7 4 ...

#> ..$ series_2: int [1:75] NA 5 8 2 1 NA 2 4 0 2 ...

#> ..$ series_3: int [1:75] 11 20 NA 36 44 34 57 50 26 28 ...

#> $ train_times :List of 3

#> ..$ series_1: int [1:75] 1 2 3 4 5 6 7 8 9 10 ...

#> ..$ series_2: int [1:75] 1 2 3 4 5 6 7 8 9 10 ...

#> ..$ series_3: int [1:75] 1 2 3 4 5 6 7 8 9 10 ...

#> $ test_observations :List of 3

#> ..$ series_1: int [1:25] 4 3 1 3 1 NA NA 7 9 8 ...

#> ..$ series_2: int [1:25] 23 NA 20 20 14 7 6 6 6 1 ...

#> ..$ series_3: int [1:25] 8 3 8 3 NA 1 1 9 8 NA ...

#> $ test_times :List of 3

#> ..$ series_1: int [1:25] 76 77 78 79 80 81 82 83 84 85 ...

#> ..$ series_2: int [1:25] 76 77 78 79 80 81 82 83 84 85 ...

#> ..$ series_3: int [1:25] 76 77 78 79 80 81 82 83 84 85 ...

#> $ hindcasts :List of 3

#> ..$ series_1: num [1:2000, 1:75] 5 4 0 2 0 5 2 4 4 0 ...

#> .. ..- attr(*, "dimnames")=List of 2

#> .. .. ..$ : NULL

#> .. .. ..$ : chr [1:75] "ypred[1,1]" "ypred[2,1]" "ypred[3,1]" "ypred[4,1]" ...

#> ..$ series_2: num [1:2000, 1:75] 1 3 0 1 4 3 3 3 2 3 ...

#> .. ..- attr(*, "dimnames")=List of 2

#> .. .. ..$ : NULL

#> .. .. ..$ : chr [1:75] "ypred[1,2]" "ypred[2,2]" "ypred[3,2]" "ypred[4,2]" ...

#> ..$ series_3: num [1:2000, 1:75] 9 14 15 14 14 16 9 14 17 16 ...

#> .. ..- attr(*, "dimnames")=List of 2

#> .. .. ..$ : NULL

#> .. .. ..$ : chr [1:75] "ypred[1,3]" "ypred[2,3]" "ypred[3,3]" "ypred[4,3]" ...

#> $ forecasts :List of 3

#> ..$ series_1: num [1:2000, 1:25] 2 1 7 2 2 4 3 5 3 1 ...

#> .. ..- attr(*, "dimnames")=List of 2

#> .. .. ..$ : NULL

#> .. .. ..$ : chr [1:25] "ypred[76,1]" "ypred[77,1]" "ypred[78,1]" "ypred[79,1]" ...

#> ..$ series_2: num [1:2000, 1:25] 17 12 15 18 19 20 22 16 15 36 ...

#> .. ..- attr(*, "dimnames")=List of 2

#> .. .. ..$ : NULL

#> .. .. ..$ : chr [1:25] "ypred[76,2]" "ypred[77,2]" "ypred[78,2]" "ypred[79,2]" ...

#> ..$ series_3: num [1:2000, 1:25] 2 3 4 3 3 4 7 2 5 3 ...

#> .. ..- attr(*, "dimnames")=List of 2

#> .. .. ..$ : NULL

#> .. .. ..$ : chr [1:25] "ypred[76,3]" "ypred[77,3]" "ypred[78,3]" "ypred[79,3]" ...

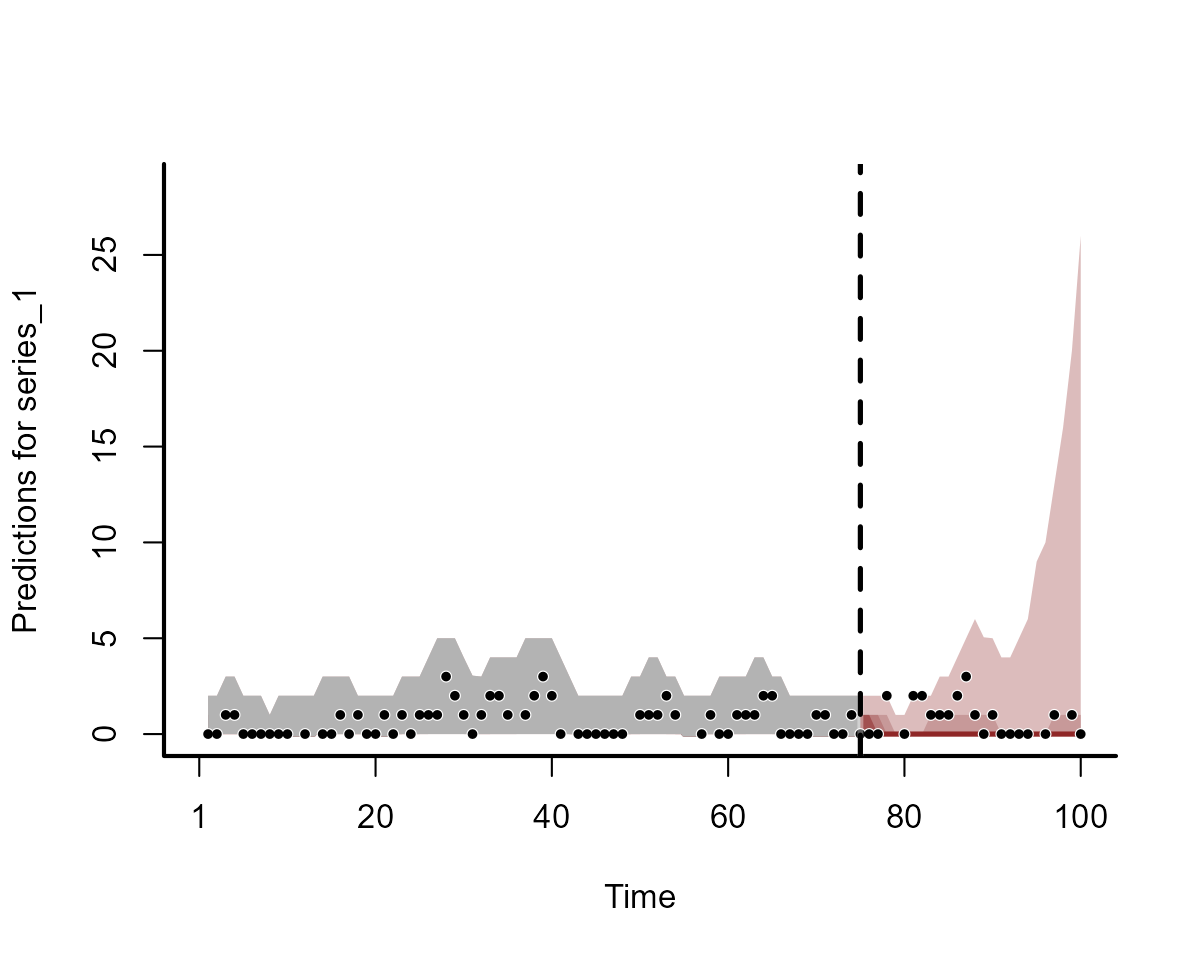

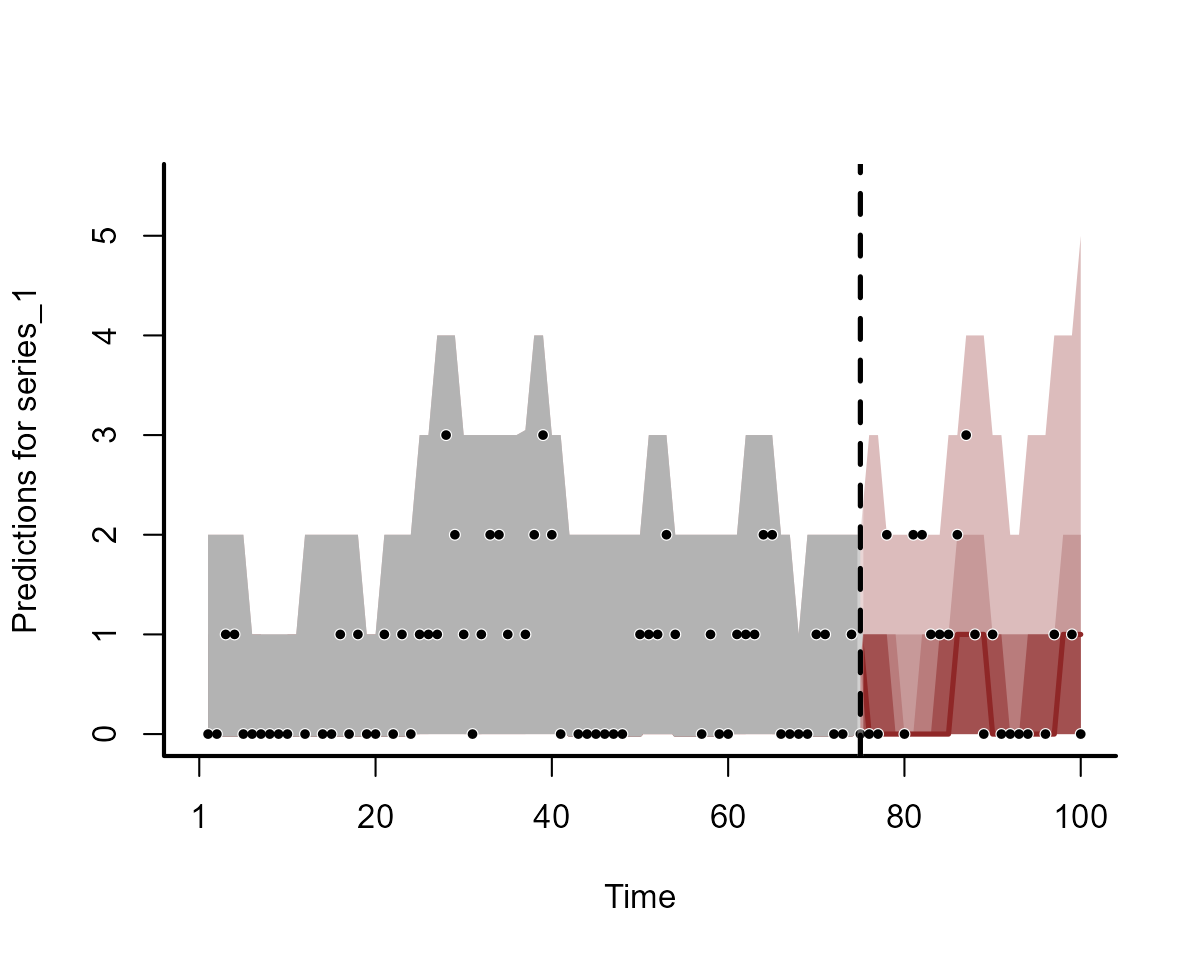

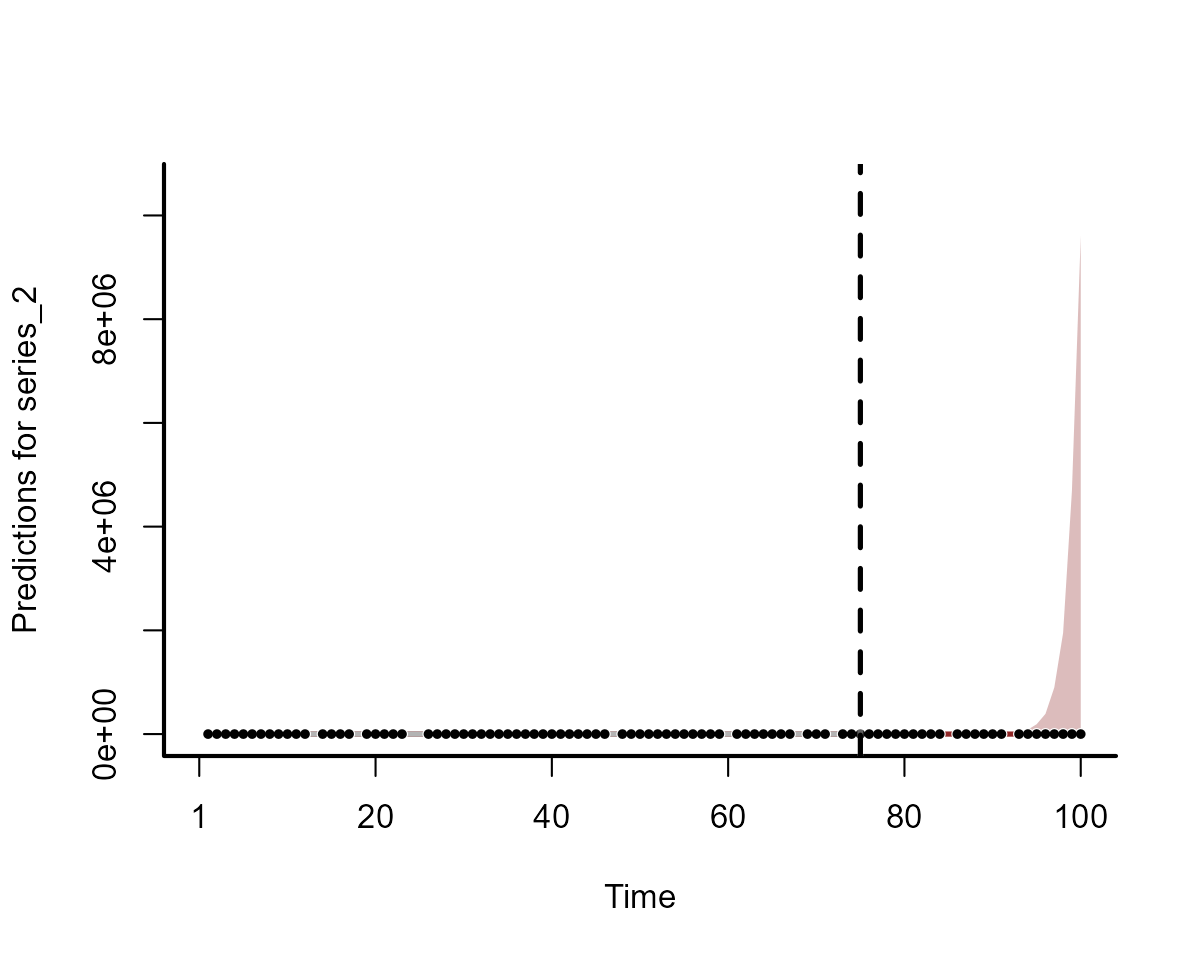

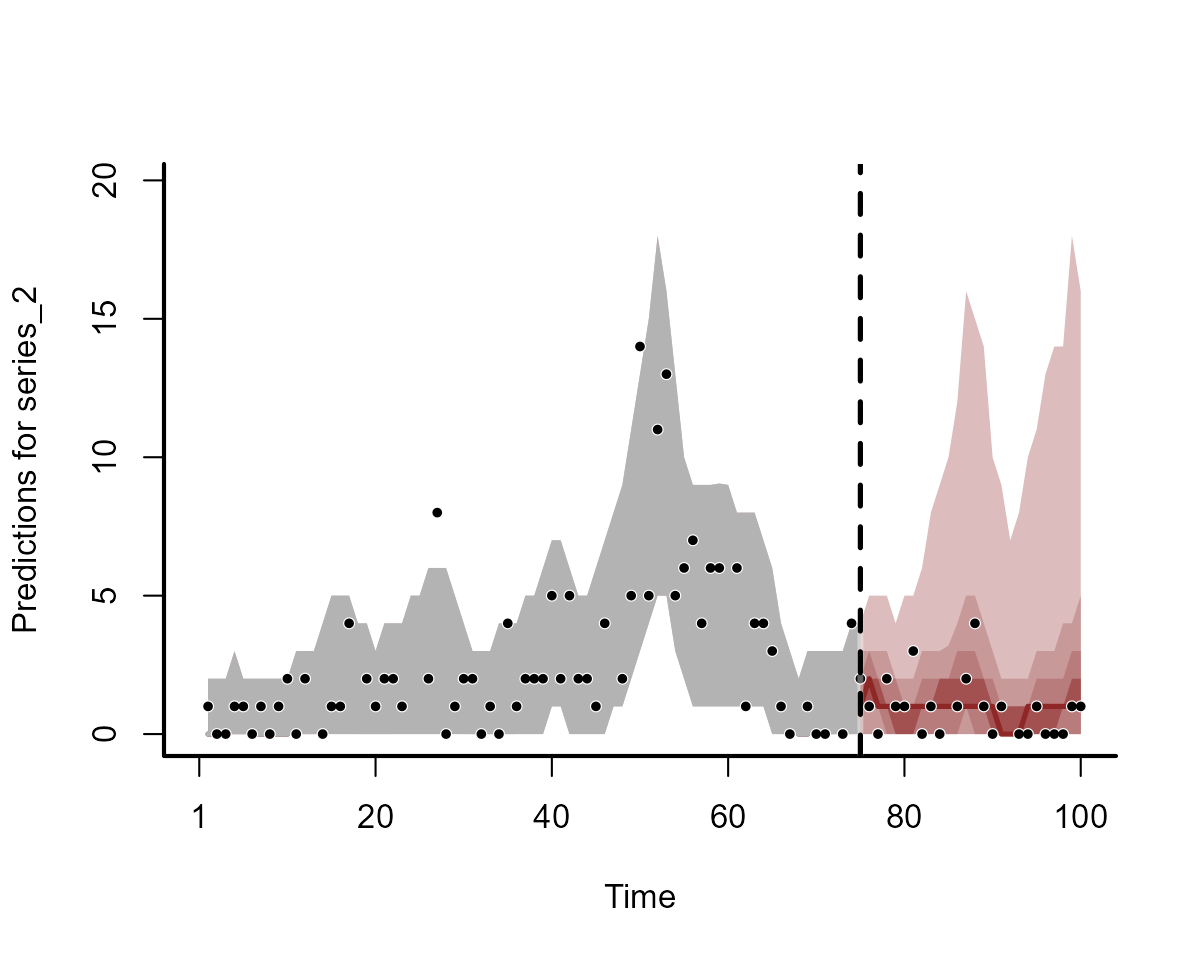

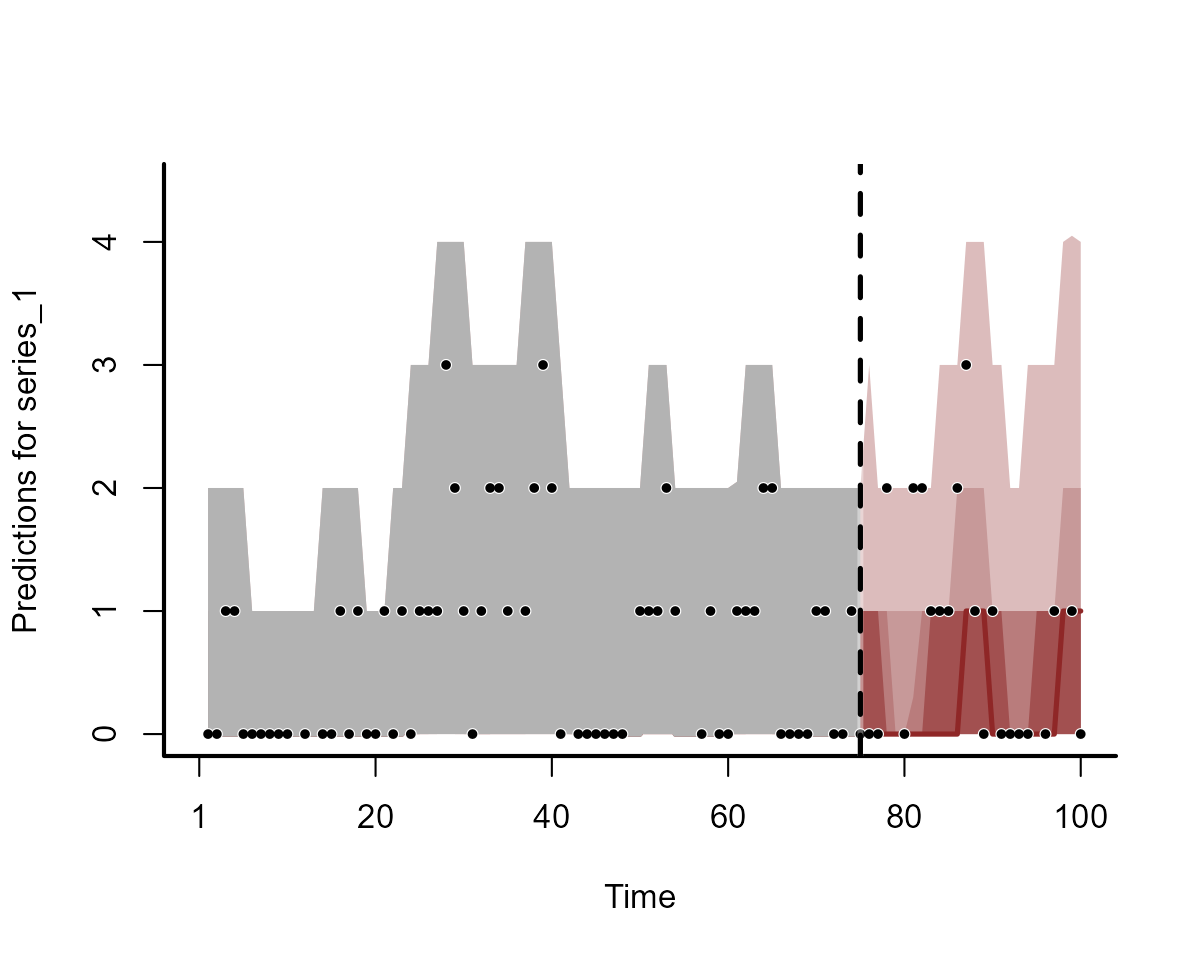

#> - attr(*, "class")= chr "mvgam_forecast"We can plot the forecasts for some series from each model using the

S3 plot method for objects of this class:

plot(fc_mod1, series = 1)

plot(fc_mod2, series = 1)

plot(fc_mod1, series = 2)

plot(fc_mod2, series = 2)

Clearly the two models do not produce equivalent forecasts. We will come back to scoring these forecasts in a moment.

Forecasting with newdata in mvgam()

The second way we can produce forecasts in mvgam is to

feed the testing data directly to the mvgam() function as

newdata. This will include the testing data as missing

observations so that they are automatically predicted from the posterior

predictive distribution using the generated quantities

block in Stan. As an example, we can refit

mod2 but include the testing data for automatic

forecasts:

mod2 <- mvgam(y ~ 1,

trend_formula = ~ s(season, bs = "cc", k = 8) - 1,

trend_knots = list(season = c(0.5, 12.5)),

trend_model = AR(cor = TRUE),

noncentred = TRUE,

data = simdat$data_train,

newdata = simdat$data_test,

silent = 2

)Because the model already contains a forecast distribution, we do not

need to feed newdata to the forecast()

function:

fc_mod2 <- forecast(mod2)The forecasts will be nearly identical to those calculated previously:

plot(fc_mod2, series = 1)

Scoring forecast distributions

A primary purpose of the mvgam_forecast class is to

readily allow forecast evaluations for each series in the data, using a

variety of possible scoring functions. See

?mvgam::score.mvgam_forecast to view the types of scores

that are available. A useful scoring metric is the Continuous Rank

Probability Score (CRPS). A CRPS value is similar to what we might get

if we calculated a weighted absolute error using the full forecast

distribution.

crps_mod1 <- score(fc_mod1, score = "crps")

str(crps_mod1)

#> List of 4

#> $ series_1 :'data.frame': 25 obs. of 5 variables:

#> ..$ score : num [1:25] 1.136 0.88 0.322 1.119 0.29 ...

#> ..$ in_interval : num [1:25] 1 1 1 1 1 NA NA 0 0 0 ...

#> ..$ interval_width: num [1:25] 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 ...

#> ..$ eval_horizon : int [1:25] 1 2 3 4 5 6 7 8 9 10 ...

#> ..$ score_type : chr [1:25] "crps" "crps" "crps" "crps" ...

#> $ series_2 :'data.frame': 25 obs. of 5 variables:

#> ..$ score : num [1:25] 2.01 NA 6.25 14.4 17.03 ...

#> ..$ in_interval : num [1:25] 1 NA 1 1 1 1 0 0 0 0 ...

#> ..$ interval_width: num [1:25] 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 ...

#> ..$ eval_horizon : int [1:25] 1 2 3 4 5 6 7 8 9 10 ...

#> ..$ score_type : chr [1:25] "crps" "crps" "crps" "crps" ...

#> $ series_3 :'data.frame': 25 obs. of 5 variables:

#> ..$ score : num [1:25] 3.617 0.466 4.168 0.491 NA ...

#> ..$ in_interval : num [1:25] 0 1 0 1 NA 1 1 0 0 NA ...

#> ..$ interval_width: num [1:25] 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 ...

#> ..$ eval_horizon : int [1:25] 1 2 3 4 5 6 7 8 9 10 ...

#> ..$ score_type : chr [1:25] "crps" "crps" "crps" "crps" ...

#> $ all_series:'data.frame': 25 obs. of 3 variables:

#> ..$ score : num [1:25] 6.76 NA 10.74 16.01 NA ...

#> ..$ eval_horizon: int [1:25] 1 2 3 4 5 6 7 8 9 10 ...

#> ..$ score_type : chr [1:25] "sum_crps" "sum_crps" "sum_crps" "sum_crps" ...

crps_mod1$series_1

#> score in_interval interval_width eval_horizon score_type

#> 1 1.1362237 1 0.9 1 crps

#> 2 0.8796700 1 0.9 2 crps

#> 3 0.3222703 1 0.9 3 crps

#> 4 1.1191818 1 0.9 4 crps

#> 5 0.2902030 1 0.9 5 crps

#> 6 NA NA 0.9 6 crps

#> 7 NA NA 0.9 7 crps

#> 8 6.2283237 0 0.9 8 crps

#> 9 8.3822845 0 0.9 9 crps

#> 10 7.4587490 0 0.9 10 crps

#> 11 21.4860392 0 0.9 11 crps

#> 12 35.3964518 0 0.9 12 crps

#> 13 37.4077225 0 0.9 13 crps

#> 14 36.5122305 0 0.9 14 crps

#> 15 39.5236040 0 0.9 15 crps

#> 16 42.4870670 0 0.9 16 crps

#> 17 42.6519410 0 0.9 17 crps

#> 18 12.8012838 0 0.9 18 crps

#> 19 13.8279528 0 0.9 19 crps

#> 20 9.8057457 0 0.9 20 crps

#> 21 4.8109472 0 0.9 21 crps

#> 22 4.8450168 0 0.9 22 crps

#> 23 2.8327210 0 0.9 23 crps

#> 24 0.8850368 1 0.9 24 crps

#> 25 3.8071090 0 0.9 25 crpsThe returned list contains a data.frame for each series

in the data that shows the CRPS score for each evaluation in the testing

data, along with some other useful information about the fit of the

forecast distribution. In particular, we are given a logical value (1s

and 0s) telling us whether the true value was within a pre-specified

credible interval (i.e. the coverage of the forecast distribution). The

default interval width is 0.9, so we would hope that the values in the

in_interval column take a 1 approximately 90% of the time.

This value can be changed if you wish to compute different coverages,

say using a 60% interval:

crps_mod1 <- score(fc_mod1, score = "crps", interval_width = 0.6)

crps_mod1$series_1

#> score in_interval interval_width eval_horizon score_type

#> 1 1.1362237 1 0.6 1 crps

#> 2 0.8796700 1 0.6 2 crps

#> 3 0.3222703 1 0.6 3 crps

#> 4 1.1191818 1 0.6 4 crps

#> 5 0.2902030 1 0.6 5 crps

#> 6 NA NA 0.6 6 crps

#> 7 NA NA 0.6 7 crps

#> 8 6.2283237 0 0.6 8 crps

#> 9 8.3822845 0 0.6 9 crps

#> 10 7.4587490 0 0.6 10 crps

#> 11 21.4860392 0 0.6 11 crps

#> 12 35.3964518 0 0.6 12 crps

#> 13 37.4077225 0 0.6 13 crps

#> 14 36.5122305 0 0.6 14 crps

#> 15 39.5236040 0 0.6 15 crps

#> 16 42.4870670 0 0.6 16 crps

#> 17 42.6519410 0 0.6 17 crps

#> 18 12.8012838 0 0.6 18 crps

#> 19 13.8279528 0 0.6 19 crps

#> 20 9.8057457 0 0.6 20 crps

#> 21 4.8109472 0 0.6 21 crps

#> 22 4.8450168 0 0.6 22 crps

#> 23 2.8327210 0 0.6 23 crps

#> 24 0.8850368 0 0.6 24 crps

#> 25 3.8071090 0 0.6 25 crpsWe can also compare forecasts against out of sample observations

using the Expected Log Predictive Density (ELPD; also known as the

log score). The ELPD is a strictly proper scoring rule that can be

applied to any distributional forecast, but to compute it we need

predictions on the link scale rather than on the outcome scale. This is

where it is advantageous to change the type of prediction we can get

using the forecast() function:

link_mod1 <- forecast(mod1, newdata = simdat$data_test, type = "link")

score(link_mod1, score = "elpd")$series_1

#> score eval_horizon score_type

#> 1 -2.232486 1 elpd

#> 2 -2.021430 2 elpd

#> 3 -1.249183 3 elpd

#> 4 -2.266812 4 elpd

#> 5 -1.252127 5 elpd

#> 6 NA 6 elpd

#> 7 NA 7 elpd

#> 8 -7.733386 8 elpd

#> 9 -9.085760 9 elpd

#> 10 -8.671512 10 elpd

#> 11 -21.237920 11 elpd

#> 12 -35.248875 12 elpd

#> 13 -34.666209 13 elpd

#> 14 -35.566399 14 elpd

#> 15 -38.164208 15 elpd

#> 16 -37.377502 16 elpd

#> 17 -46.300754 17 elpd

#> 18 -13.527249 18 elpd

#> 19 -14.289927 19 elpd

#> 20 -9.302892 20 elpd

#> 21 -7.084534 21 elpd

#> 22 -7.179677 22 elpd

#> 23 -5.787680 23 elpd

#> 24 -3.175058 24 elpd

#> 25 -6.243911 25 elpdFinally, when we have multiple time series it may also make sense to

use a multivariate proper scoring rule. mvgam offers two

such options: the Energy score and the Variogram score. The first

penalizes forecast distributions that are less well calibrated against

the truth, while the second penalizes forecasts that do not capture the

observed true correlation structure. Which score to use depends on your

goals, but both are very easy to compute:

energy_mod2 <- score(fc_mod2, score = "energy")

str(energy_mod2)

#> List of 4

#> $ series_1 :'data.frame': 25 obs. of 3 variables:

#> ..$ in_interval : num [1:25] 1 1 1 1 1 NA NA 1 1 1 ...

#> ..$ interval_width: num [1:25] 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 ...

#> ..$ eval_horizon : int [1:25] 1 2 3 4 5 6 7 8 9 10 ...

#> $ series_2 :'data.frame': 25 obs. of 3 variables:

#> ..$ in_interval : num [1:25] 1 NA 1 1 1 1 1 1 1 1 ...

#> ..$ interval_width: num [1:25] 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 ...

#> ..$ eval_horizon : int [1:25] 1 2 3 4 5 6 7 8 9 10 ...

#> $ series_3 :'data.frame': 25 obs. of 3 variables:

#> ..$ in_interval : num [1:25] 1 1 1 1 NA 1 1 1 1 NA ...

#> ..$ interval_width: num [1:25] 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 ...

#> ..$ eval_horizon : int [1:25] 1 2 3 4 5 6 7 8 9 10 ...

#> $ all_series:'data.frame': 25 obs. of 3 variables:

#> ..$ score : num [1:25] 4.63 NA 4.9 5.31 NA ...

#> ..$ eval_horizon: int [1:25] 1 2 3 4 5 6 7 8 9 10 ...

#> ..$ score_type : chr [1:25] "energy" "energy" "energy" "energy" ...The returned object still provides information on interval coverage

for each individual series, but there is only a single score per horizon

now (which is provided in the all_series slot):

energy_mod2$all_series

#> score eval_horizon score_type

#> 1 4.629134 1 energy

#> 2 NA 2 energy

#> 3 4.900093 3 energy

#> 4 5.311694 4 energy

#> 5 NA 5 energy

#> 6 NA 6 energy

#> 7 NA 7 energy

#> 8 4.044452 8 energy

#> 9 4.246800 9 energy

#> 10 NA 10 energy

#> 11 13.280149 11 energy

#> 12 22.410607 12 energy

#> 13 NA 13 energy

#> 14 21.461344 14 energy

#> 15 24.363040 15 energy

#> 16 25.165441 16 energy

#> 17 28.254463 17 energy

#> 18 6.332612 18 energy

#> 19 10.925300 19 energy

#> 20 4.214958 20 energy

#> 21 2.931371 21 energy

#> 22 3.505633 22 energy

#> 23 NA 23 energy

#> 24 8.815670 24 energy

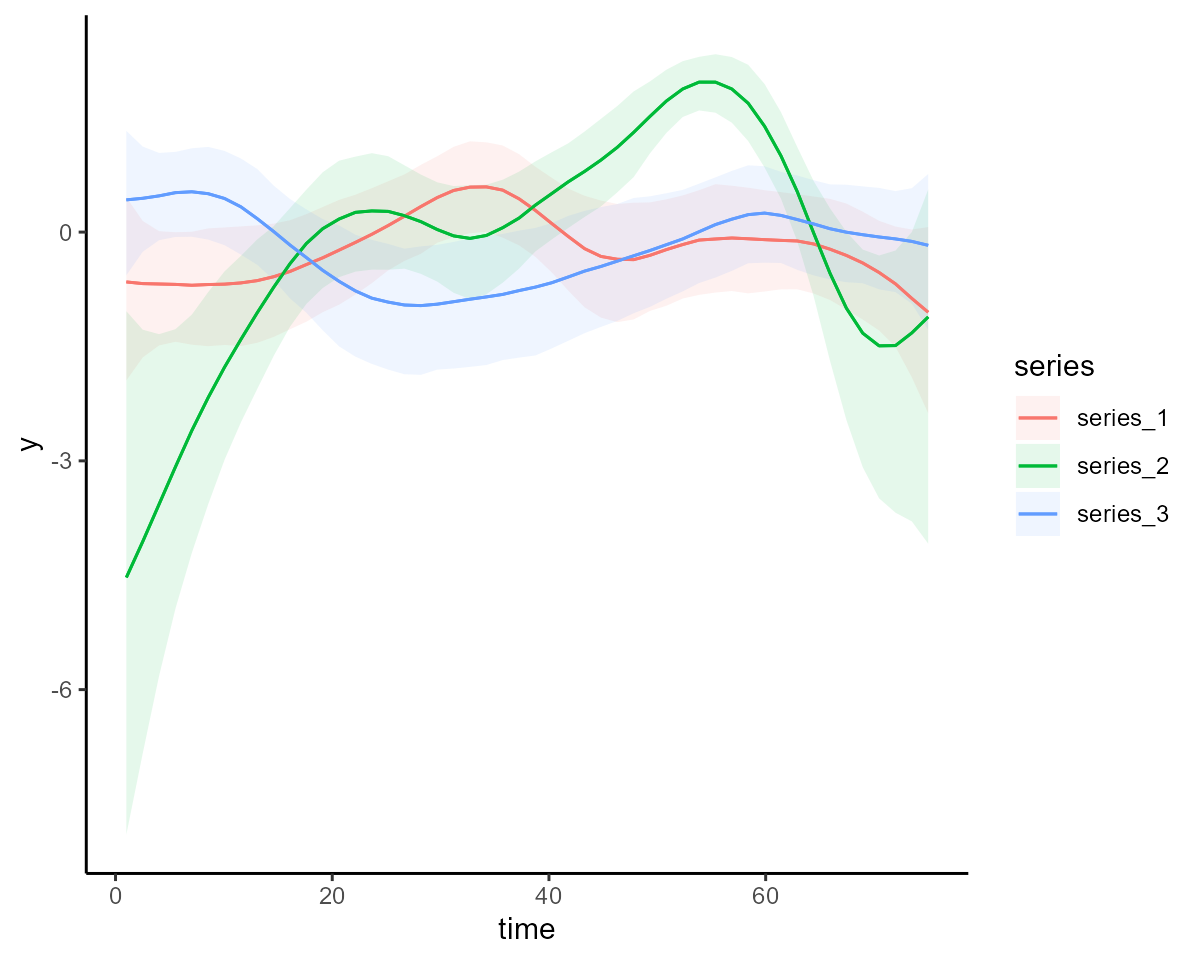

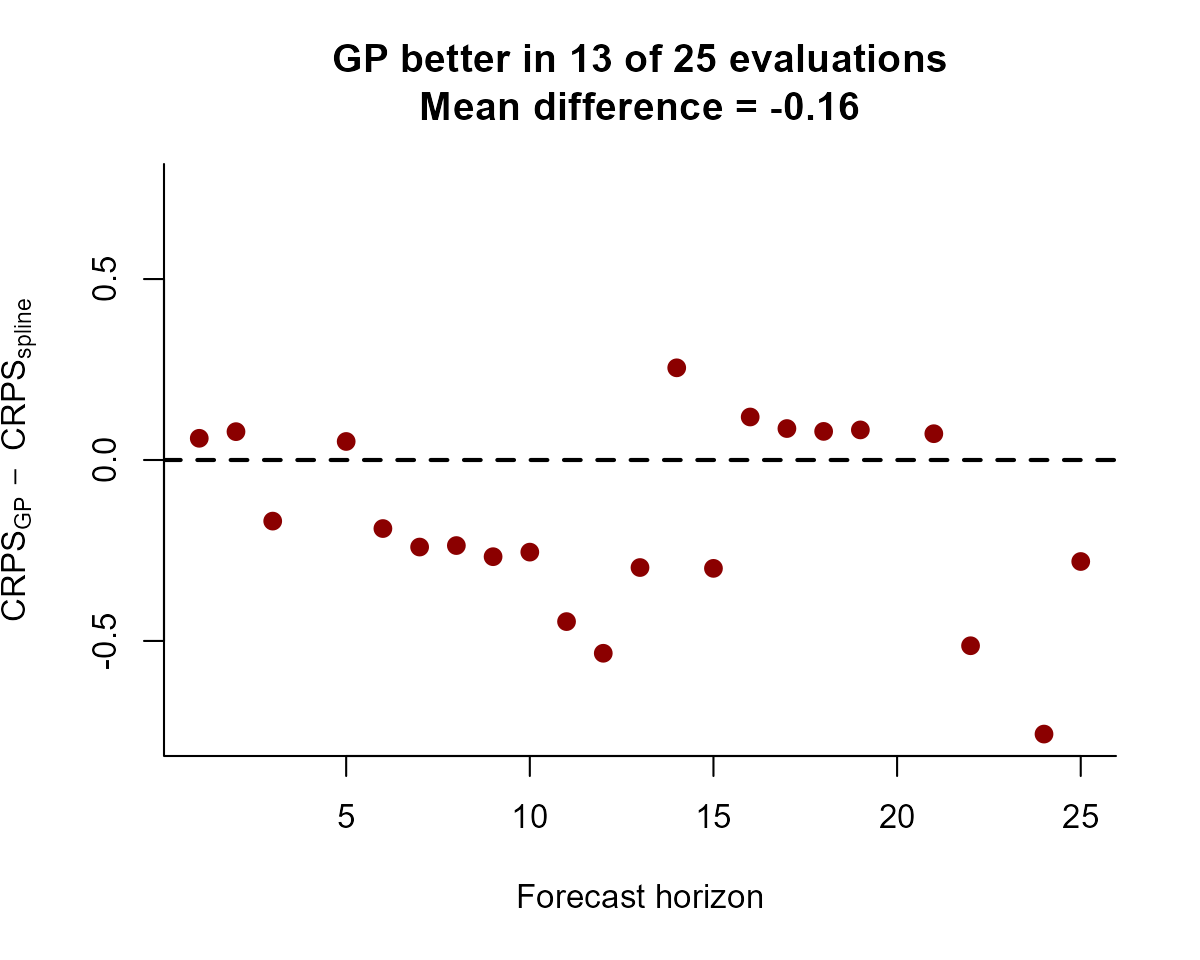

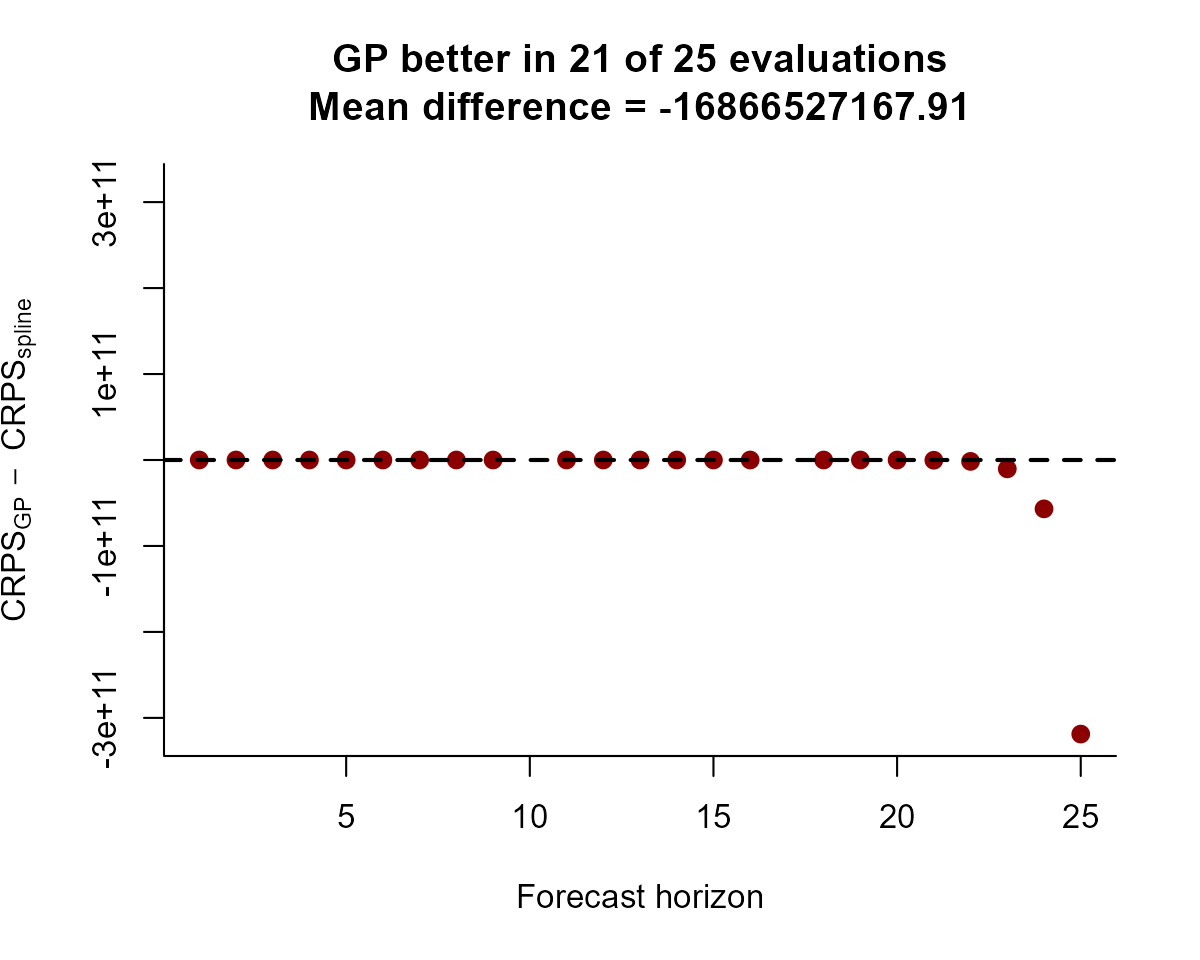

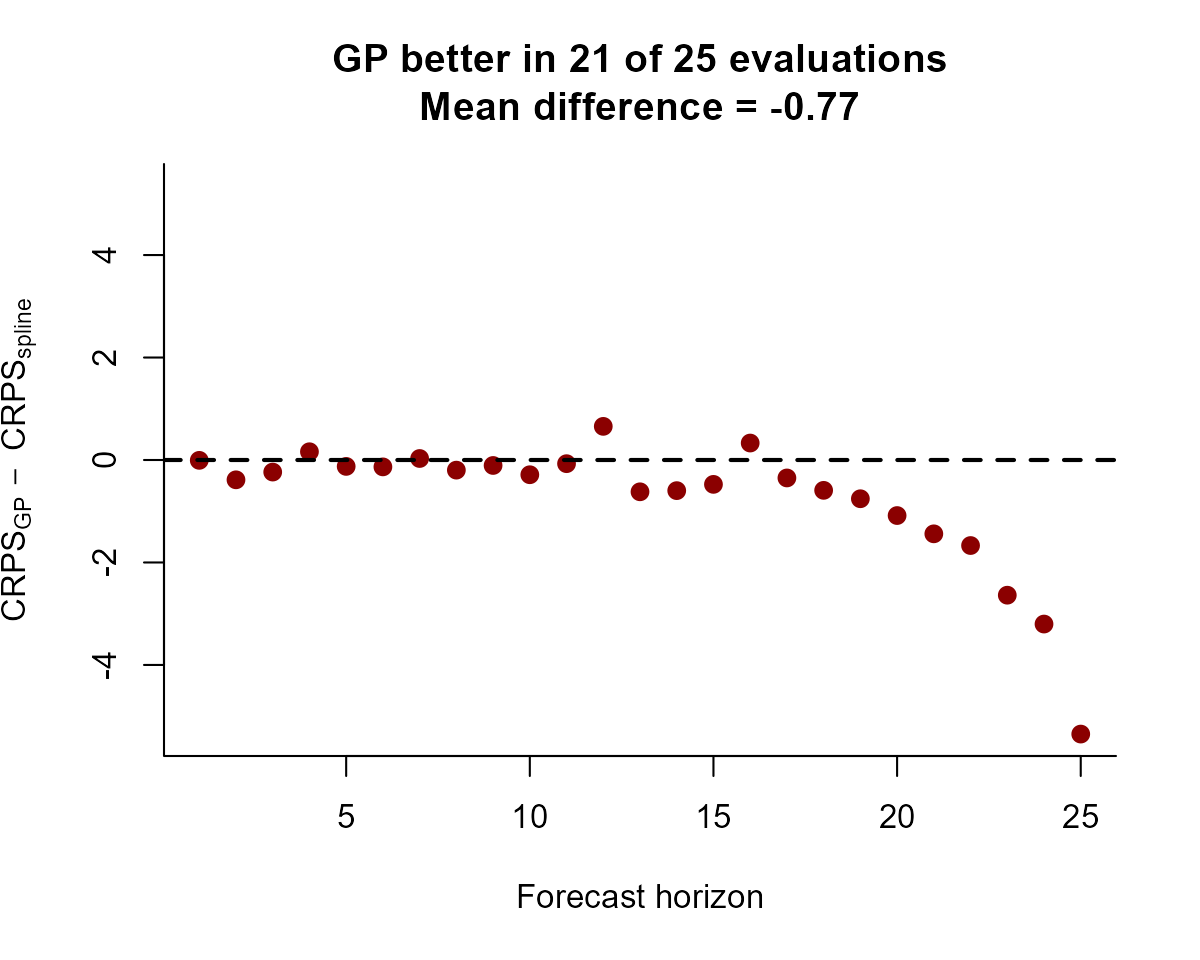

#> 25 7.770083 25 energyYou can use your score(s) of choice to compare different models. For

example, we can compute and plot the difference in CRPS scores for each

series in data. Here, a negative value means the AR(1) model

(mod2) is better, while a positive value means the spline

model (mod1) is better.

crps_mod1 <- score(fc_mod1, score = "crps")

crps_mod2 <- score(fc_mod2, score = "crps")

diff_scores <- crps_mod2$series_1$score -

crps_mod1$series_1$score

plot(diff_scores,

pch = 16, cex = 1.25, col = "darkred",

ylim = c(

-1 * max(abs(diff_scores), na.rm = TRUE),

max(abs(diff_scores), na.rm = TRUE)

),

bty = "l",

xlab = "Forecast horizon",

ylab = expression(CRPS[AR1] ~ -~ CRPS[spline])

)

abline(h = 0, lty = "dashed", lwd = 2)

ar1_better <- length(which(diff_scores < 0))

title(main = paste0(

"AR(1) better in ",

ar1_better,

" of ",

length(diff_scores),

" evaluations",

"\nMean difference = ",

round(mean(diff_scores, na.rm = TRUE), 2)

))

diff_scores <- crps_mod2$series_2$score -

crps_mod1$series_2$score

plot(diff_scores,

pch = 16, cex = 1.25, col = "darkred",

ylim = c(

-1 * max(abs(diff_scores), na.rm = TRUE),

max(abs(diff_scores), na.rm = TRUE)

),

bty = "l",

xlab = "Forecast horizon",

ylab = expression(CRPS[AR1] ~ -~ CRPS[spline])

)

abline(h = 0, lty = "dashed", lwd = 2)

ar1_better <- length(which(diff_scores < 0))

title(main = paste0(

"AR(1) better in ",

ar1_better,

" of ",

length(diff_scores),

" evaluations",

"\nMean difference = ",

round(mean(diff_scores, na.rm = TRUE), 2)

))

diff_scores <- crps_mod2$series_3$score -

crps_mod1$series_3$score

plot(diff_scores,

pch = 16, cex = 1.25, col = "darkred",

ylim = c(

-1 * max(abs(diff_scores), na.rm = TRUE),

max(abs(diff_scores), na.rm = TRUE)

),

bty = "l",

xlab = "Forecast horizon",

ylab = expression(CRPS[AR1] ~ -~ CRPS[spline])

)

abline(h = 0, lty = "dashed", lwd = 2)

ar1_better <- length(which(diff_scores < 0))

title(main = paste0(

"AR(1) better in ",

ar1_better,

" of ",

length(diff_scores),

" evaluations",

"\nMean difference = ",

round(mean(diff_scores, na.rm = TRUE), 2)

))

The correlated AR(1) model consistently gives better forecasts, and the difference between scores tends to grow as the forecast horizon increases. This is not unexpected given the way that splines linearly extrapolate outside the range of training data

Further reading

The following papers and resources offer useful material about Bayesian forecasting and proper scoring rules:

Clark N.J., et al. Beyond single-species models: leveraging multispecies forecasts to navigate the dynamics of ecological predictability. PeerJ 13:e18929 (2025) https://doi.org/10.7717/peerj.18929

Hyndman, Rob J., and George Athanasopoulos. Forecasting: principles and practice. OTexts, (2018).

Gneiting, Tilmann, and Adrian E. Raftery. Strictly proper scoring rules, prediction, and estimation Journal of the American statistical Association 102.477 (2007) 359-378.

Simonis, Juniper L., et al. Evaluating probabilistic ecological forecasts Ecology 102.8 (2021) e03431.

Interested in contributing?

I’m actively seeking PhD students and other researchers to work in

the areas of ecological forecasting, multivariate model evaluation and

development of mvgam. Please see this small list of

opportunities on my website and do reach out if you are interested

(n.clark’at’uq.edu.au)