This function simulates sets of time series data for fitting a multivariate GAM that includes shared seasonality and dependence on State-Space latent dynamic factors. Random dependencies among series, i.e. correlations in their long-term trends, are included in the form of correlated loadings on the latent dynamic factors

Arguments

- T

integer. Number of observations (timepoints)- n_series

integer. Number of discrete time series- seasonality

character. Eithershared, meaning that all series share the exact same seasonal pattern, orhierarchical, meaning that there is a global seasonality but each series' pattern can deviate slightly- use_lv

logical. IfTRUE, use dynamic factors to estimate series' latent trends in a reduced dimension format. IfFALSE, estimate independent latent trends for each series- n_lv

integer. Number of latent dynamic factors for generating the series' trends. Defaults to0, meaning that dynamics are estimated independently for each series- trend_model

characterspecifying the time series dynamics for the latent trend. Options are:None(no latent trend component; i.e. the GAM component is all that contributes to the linear predictor, and the observation process is the only source of error; similarly to what is estimated bygam)RW(random walk with possible drift)AR1(with possible drift)AR2(with possible drift)AR3(with possible drift)VAR1(contemporaneously uncorrelated VAR1)VAR1cor(contemporaneously correlated VAR1)GP(Gaussian Process with squared exponential kernel)

See mvgam_trends for more details

- drift

logical, simulate a drift term for each trend- prop_trend

numeric. Relative importance of the trend for each series. Should be between0and1- trend_rel

Deprecated. Use

prop_trendinstead- freq

integer. The seasonal frequency of the series- family

familyspecifying the exponential observation family for the series. Currently supported families are:nb(),poisson(),bernoulli(),tweedie(),gaussian(),betar(),lognormal(),student()andGamma()- phi

vectorof dispersion parameters for the series (i.e.sizefornb()orphiforbetar()). Iflength(phi) < n_series, the first element ofphiwill be replicatedn_seriestimes. Defaults to5fornb()andtweedie();10forbetar()- shape

vectorof shape parameters for the series (i.e.shapeforgamma()). Iflength(shape) < n_series, the first element ofshapewill be replicatedn_seriestimes. Defaults to10- sigma

vectorof scale parameters for the series (i.e.sdforgaussian()orstudent(),log(sd)forlognormal()). Iflength(sigma) < n_series, the first element ofsigmawill be replicatedn_seriestimes. Defaults to0.5forgaussian()andstudent();0.2forlognormal()- nu

vectorof degrees of freedom parameters for the series (i.e.nuforstudent()). Iflength(nu) < n_series, the first element ofnuwill be replicatedn_seriestimes. Defaults to3- mu

vectorof location parameters for the series. Iflength(mu) < n_series, the first element ofmuwill be replicatedn_seriestimes. Defaults to small random values between-0.5and0.5on the link scale- prop_missing

numericstating proportion of observations that are missing. Should be between0and0.8, inclusive- prop_train

numericstating the proportion of data to use for training. Should be between0.2and1

Value

A list object containing outputs needed for

mvgam, including 'data_train' and 'data_test', as well

as some additional information about the simulated seasonality and

trend dependencies

References

Clark, N. J. and Wells, K. (2022). Dynamic generalised additive models (DGAMs) for forecasting discrete ecological time series. Methods in Ecology and Evolution, 13(11), 2388-2404. doi:10.1111/2041-210X.13974

Examples

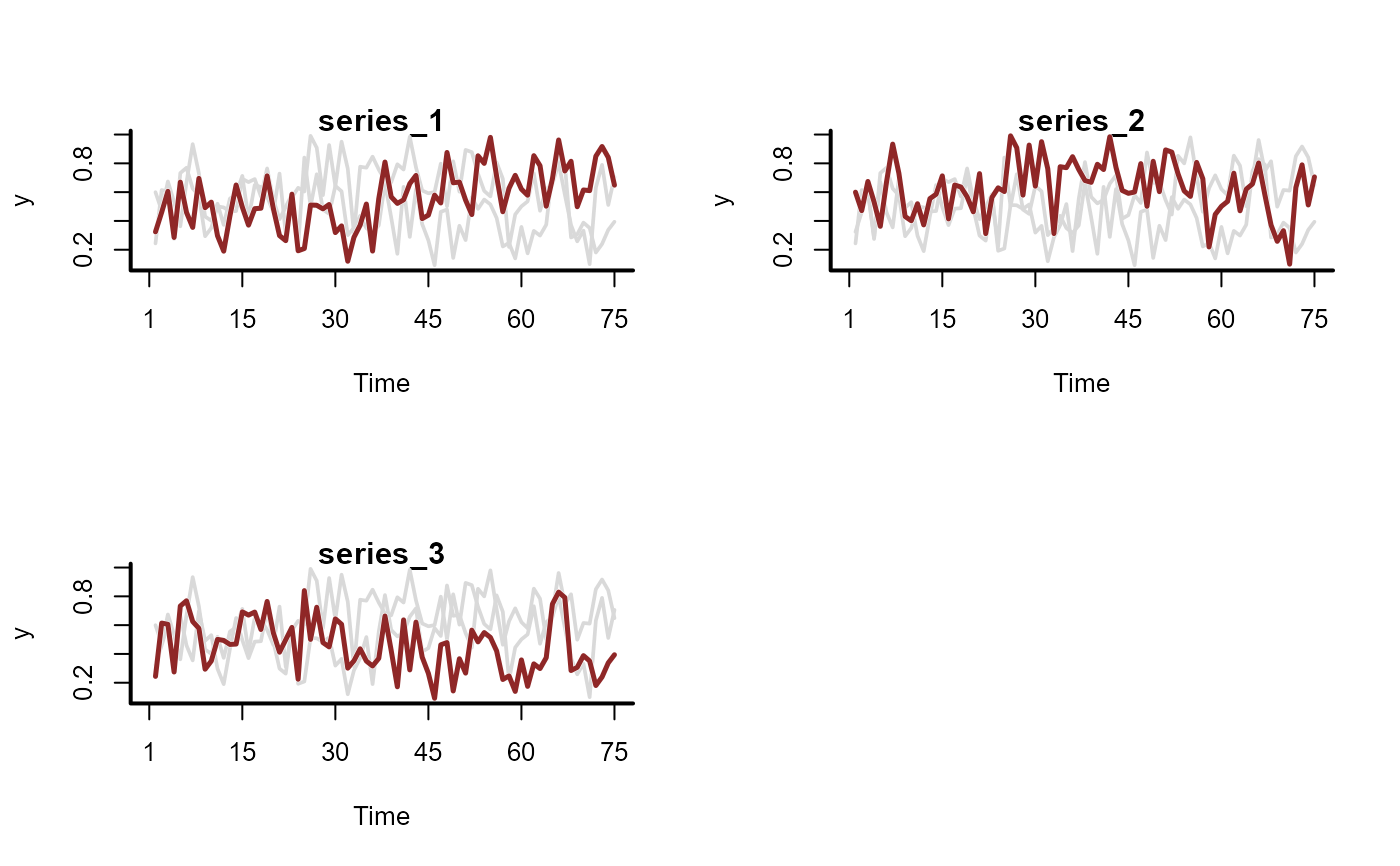

# Simulate series with observations bounded at 0 and 1 (Beta responses)

sim_data <- sim_mvgam(

family = betar(),

trend_model = RW(),

prop_trend = 0.6

)

plot_mvgam_series(data = sim_data$data_train, series = 'all')

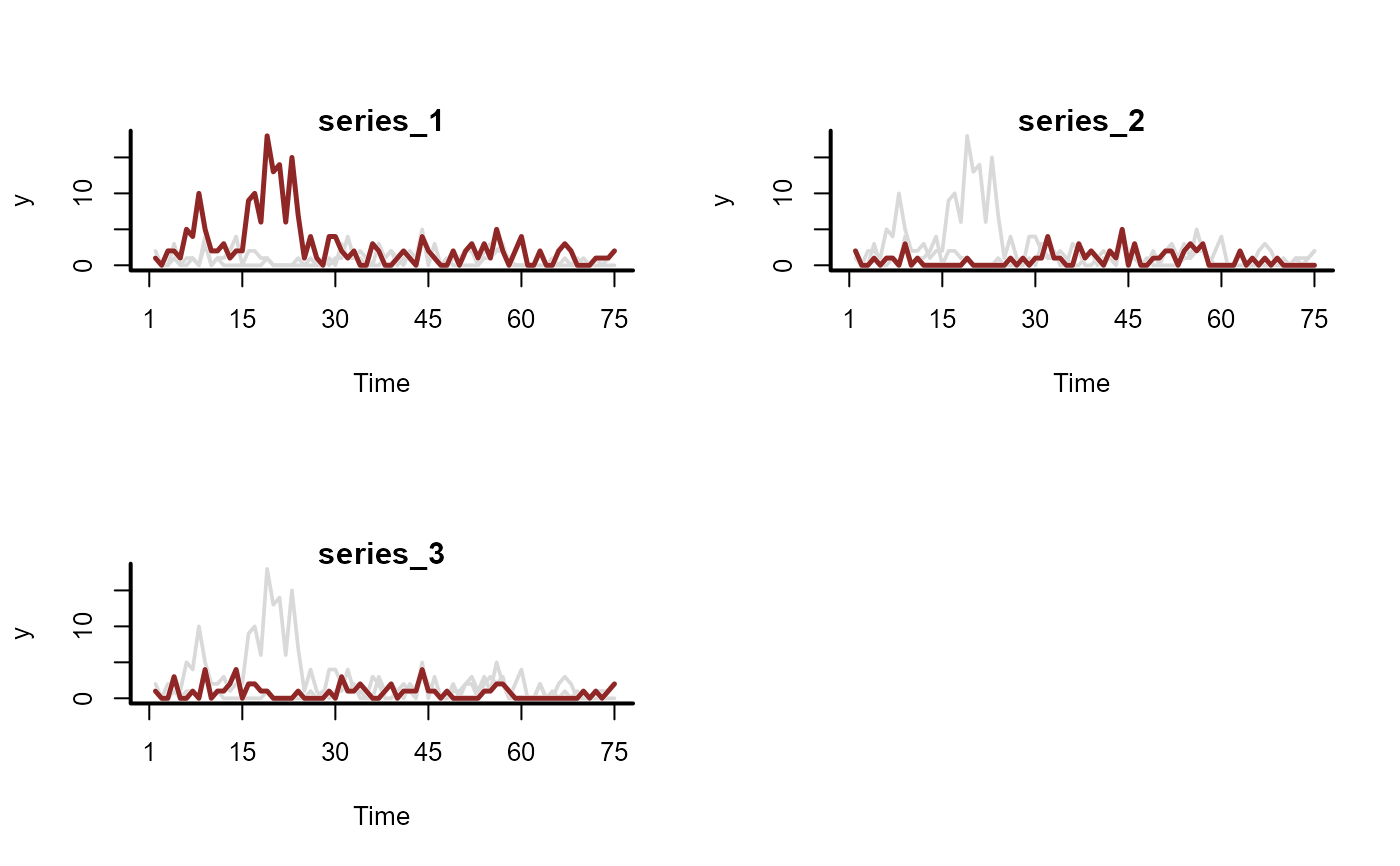

# Now simulate series with overdispersed discrete observations

sim_data <- sim_mvgam(

family = nb(),

trend_model = RW(),

prop_trend = 0.6,

phi = 10

)

plot_mvgam_series(data = sim_data$data_train, series = 'all')

# Now simulate series with overdispersed discrete observations

sim_data <- sim_mvgam(

family = nb(),

trend_model = RW(),

prop_trend = 0.6,

phi = 10

)

plot_mvgam_series(data = sim_data$data_train, series = 'all')